Mixed funds enjoy worldwide popularity. This asset class is also often found in the investment portfolios of German investors. Every year billions flow into the products that mix stocks, real estate and bonds and thus promise greater security.

Unlike a pure equity fund, mixed funds (mixed securities funds) invest in several asset classes. A mixed fund can invest in bonds, money market stocks, commodities, precious metals, real estate and, of course, stocks as well. The mix ratio depends on the respective fund strategy. The fund management of a mixed fund can flexibly adjust the weighting of the asset classes as part of the fund-specific investment concept. If, for example, prices on the stock markets drop from time to time, more investments can be made in bonds, thereby taking advantage of opportunities or mitigating losses. This form of fund combines growth opportunities from riskier investments such as stocks with income from lower risk investments such as bonds and real estate investments. Below we present our 5 most popular mixed funds.

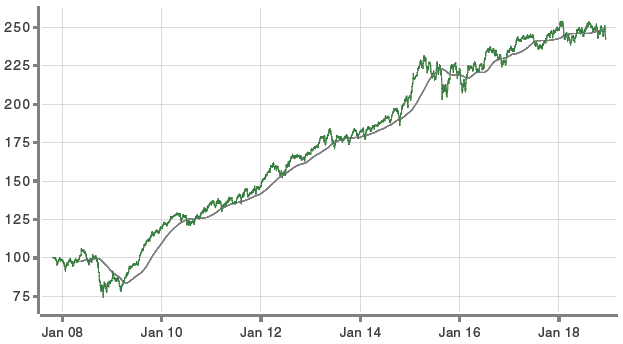

Flossbach von Storch SICAV – Multiple Opportunities R

ISIN: LU0061928585 |WKN: 974968| Currency: EUR

Chart: Flossbach von Storch SICAV – Multiple Opportunities R

The investment objective is appropriate growth in value in euros. The fund invests its assets in all kinds of securities, including stocks, bonds of all kinds (e.g. zero-coupon bonds and floating-rate securities as well as convertible and option bonds), money market instruments, certificates, gold, other funds and fixed-term deposits. At least 25% of the fund’s assets are invested in equity investments. Up to 15% of the fund’s assets may be invested directly in gold.

Best Opportunity Concept

ISIN: LU0061928585 |WKN: 974968| Currency: EUR

Chart: Best Opportunity Concept

The aim of the fund’s investment policy is to generate attractive growth in value in euros as part of a long-term strategy. In order to achieve this investment objective, the fund’s assets are predominantly invested in units of open-ended equity, bond and permissible specialty funds, which invest the incoming assets internationally. In addition, however, shares in mixed securities funds, money market-related funds or money market funds can also be acquired and liquid assets can be held.

Allianz Strategy Funds Growth -A- EUR

ISIN: DE0009797266 |WKN: 979726| Currency: EUR

Chart: Allianz Strategy Funds Growth -A- EUR

Investment goals are long-term capital growth and a return in line with the market. The fund invests between 65% and 85% of its assets directly or via derivatives in equities and comparable papers. He also invests in interest-bearing securities that have good credit ratings. These securities have an average remaining term of between 3 and 9 years. Most of the issuers of the shares and interest-bearing securities come from industrialized countries. The foreign currency risk against the euro is limited to a maximum of 5% of the fund’s assets.

Investec GSF – Global Strategic Managed Fund A Acc gross USD

ISIN: LU0345768153 |WKN: A0QYDT| Currency: USD

Chart: Investec GSF – Global Strategic Managed Fund A Acc gross USD

The investment objective is long-term total returns. The fund invests in a diversified and actively managed portfolio of any combination of liquid instruments, fixed income securities, convertible bonds and listed stocks at an international level. The equity component is usually limited to a maximum of 75% of the fund. The use of derivatives is possible.

Flossbach von Storch SICAV – Multi Asset-Balanced I

ISIN: LU0323578061 |WKN: A0M43V| Currency: EUR

Chart: Flossbach von Storch SICAV – Multi Asset-Balanced I

The investment objective is appropriate growth in value in euros. The fund invests in securities, including stocks (max. 55%), bonds, money market instruments, certificates, other structured products (e.g. reverse convertible bonds, bonds with warrants, convertible bonds), funds, derivatives, liquid assets and time deposits of all kinds. At least 25% of the Fund assets invested in equity investments. Up to 20% of the fund’s assets may be invested indirectly in precious metals. Investments in other funds may not exceed 10% of the fund’s assets.

We would be happy to advise and support you in choosing the right funds and optimizing your portfolio. Get your independent opinion now, without obligation.