Wealth management

In contrast to classic, purely monetary asset management, we understand asset structuring as an elementary component of comprehensive life planning. Always in line with your very own, individual goals and ideas. With this planning we want to accompany you trustingly and reliably to the best of our knowledge and belief.

As an active partner who is always at your side for dialogue and who always has an open ear for your wishes. Our goal is not your short-term profit, but your long-term satisfaction.

Very important: We are not a bank and we do not have our own investment products. We are exclusively an independent consultant who designs asset accumulation and thus the future for and with his clients. We will inform you about the best ways and possibilities for a successful capital accumulation and help you with every step. We look forward to the common path.

Investing shouldn’t be a game of chance. And not a book with seven seals. We focus on transparency and simple design options. We therefore largely rely on investment funds for our investment recommendations. For this purpose, we subject all of the more than 10,000 investment funds currently approved on the market to our own quantitative and qualitative analysis. This also includes the ratings of renowned rating agencies, among other things. The result is a continuously optimized selection of top funds from the areas of stocks, bonds, real estate and money market. For our investment recommendation, we now select those funds that best match your risk-benefit profile.

Very important: We are neither a bank nor an insurance company. We are independent investment advisors who want to shape assets and thus the future for and with their clients. We therefore provide independent and transparent information about the best ways and possibilities for a successful capital build-up and help our clients with every step.

Only those who are independent can make their own decisions.

In-depth advice and an intensive dialogue between investors and asset managers are the basis of every successful capital investment. Only when we know you, your needs and wishes, when our experts can put themselves in your position, will you achieve optimal results with your investment. After our discussions, we will work out an individual risk-benefit profile for you in the next step, in which various customer parameters are incorporated. You benefit from our many years of experience in combination with the latest computer and analysis technology.

All relevant information is taken into account according to a defined weighting – the result reflects your very own investment requirements.

Investing shouldn’t be a game of chance. And not a book with seven seals. We focus on transparency and simple design options – entirely in the interests of our customers. We therefore only rely on investment funds for our investment recommendations. Not for any, but for the best. For this purpose, we subject all of the more than 10,000 investment funds currently approved on the market to our own quantitative and qualitative analysis. This also includes the ratings of renowned rating agencies, among other things.

The end result is a continuously optimized selection of top funds from the areas of stocks, bonds, real estate and money market. From these, we will now select those for our investment recommendation that best match your risk-benefit profile.

Private retirement provision

In the area of old-age provision, we will inform you about the advantages and disadvantages of the various old-age provision products and, together with you, design a pension that is tailored to your wishes and needs.

The question of whether the statutory pensions are safe or not has been a controversial issue for decades. Regardless of this, private old-age provision gives you significantly increased financial security and you no longer need to rely on a single pension system. Accordingly, we understand the concept of private old-age provision basically as nothing more than long-term asset accumulation for the retirement age. Different strategies and products can be selected depending on the individual life situation. In addition to securities, funds or real estate, insurance is also offered as a pension product. When choosing the right product, age, investment amount, desired flexibility and willingness to take risks all play a decisive role.

Private retirement provision can be realized through various products. The focus should always be on the financial security of your investment. Depending on how you want to organize your private retirement provision, some products can also generate attractive long-term returns. If you are a very conservative investor and above all want a safe investment, there are so-called guarantee funds, which regularly hedge the profits. Although this leads to a rather lower return in real terms compared to products without a guarantee promise, it offers the security of a capital-forming life insurance with a reasonable return. For some old-age provision products, the state also grants a subsidy or a tax advantage in the savings or disbursement phase.However, many of these state-sponsored products such as Riester pension or Rürup also have many disadvantages and are not recommended for our customers in our concepts. We would be happy to advise you in detail on all products.

Employer-funded pension

In Germany, the company pension scheme is based on the principle of voluntariness. The employer alone decides whether, how, for whom, under what conditions and via which pension formula. A company pension once created is then subject to the standards of the Company Pension Act (BetrAVG). The employer is bound by the principle of equality in accordance with Article 3 of the Basic Law.

Direct or pension commitment:

Also known as internal funding, as the capital is accumulated within the company. The employer fully bears the biometric risks. (If necessary, these will be given via a reinsurance policy) The services to be provided represent liabilities for the employer that will become due in the future. Therefore, pension provisions are set up by the employer, which reduce the taxable profit.

Pension fund:

The company pensions are paid by a legally independent fund that is set up by the employer as a small mutual insurance association for this purpose. The employer continuously provides the pension fund with the necessary financial resources in advance during the build-up phase so that it can raise the pension benefits promised by the company pension fund for its former employees. The provider of the pension is not directly the employer, but indirectly the pension fund. This means that the employee has a direct legal claim against the pension fund for the benefits of the pension.

Direct insurance:

the benefits are provided by an insurer. The employer concludes a life insurance contract for his employees with a life insurer. In the event of an insured event, the pension benefit is paid by the life insurer. Endowment life insurance, annuity insurance, term life insurance, unit-linked life and annuity insurance (with premium maintenance guarantee), independent employment / occupational disability insurance, dread disease policies, accident insurance with premium refund are permitted.

Benefit

fund : It does not grant any legal entitlement to the benefits, which is why it is not subject to state insurance supervision. The services are financed through grants from the sponsoring company (employer) during the savings phase of the later pension. The benevolent fund pays for the employer in the event of a pension.

Pension fund:

The pension fund is an external provider of the company pension scheme, which grants the employee a legal right to a company pension. When changing employers, employees can take their acquired entitlements with them. The assets accumulated in the fund to meet the company pension obligations are outsourced from the company, which means that they do not have to be accounted for and the company’s equity ratio improves. The pension fund pays lifelong old-age pensions. It is essential that they have much greater freedom in investing their assets than the pension fund.

Fraud: Riester pension

As part of our advisory concept, we also see our duty to provide information and, in contrast to the market, do not recommend a Riester pension. On the contrary, we even warn of the disadvantages and recommend our customers to shut down or terminate recently concluded Riester contracts.

“The very legal fraud with the Riester pension.”

The state-sponsored Riester pension to top up the statutory pension has been in existence for around 15 years. The first contracts have now been paid out – the results are even worse than feared. In addition, negative analyzes by actuaries are increasing. According to their calculations, one would have to be over 100 years old to be able to benefit from a return of around 2%. Our calculations also showed that most of the state subsidies often end up in the pockets of the insurer and not with the actual saver. As is so often the case, the taxpayer has to pay for it again.

In addition to the disadvantages already mentioned, it is particularly difficult for low-income earners that the Riester pension must be offset against the basic security in old age according to the current legal situation. This means that the state subsidy pension is even less worthwhile for low-wage earners or for people who have been unemployed for a long time, as all income from the Riester pension minimizes the right to basic security.

You are welcome to take a look at our videos on the blog or use the following videos on YouTube for more information about Riester.

ZDF Frontal: Riester, Questionable Promises

http://www.youtube.com/watch?v=qgLb0cdbCdI

Monitor via Riester

http://www.youtube.com/watch?v=YadFbWism4c

The rip-off with the Riester pension (ARD)

http://www.youtube.com/watch?v=fgdUJzxEpyo

Investment portfolio

One of our main focuses is the long-term wealth accumulation and capital management of our clients. To this end, we create maturity-oriented model portfolios that are optimized or selected based on the customer’s individual investment requirements. The strategic division into the classic capital markets is defined as well as the division into the so-called target funds. By choosing the target funds (core investment) and their respective allocation and adding satellites (satellite investment), a tactical asset allocation (TAA) is carried out in addition to the strategic asset allocation (SAA).

In addition to standard clients such as fund and classic asset management, our range of asset management services also includes individually designed solutions in the form of so-called special mandates. These special mandates are conceivable in different forms, such as purely index-oriented or purist portfolios, special investment ideologies of our customers (green investments), combinations of different approaches or individual approaches for associations, pension funds or foundations.

Our approach to completely dispense with the issue surcharge and to work with a service fee results in completely flexible options for our management of the investment portfolio without any costs for our customers. You will find some sample portfolios defined below.

Short-term portfolios:

For short-term investment portfolios, we focus on bond funds with short fixed interest rates. The investment objective is often to achieve regular income in the amount of time deposits, bonds with variable coupons or euro bonds during the year.

Medium-term portfolios (conservative):

The focus of this model portfolio is on achieving stable investment success with high-yield properties in economically strong locations in the European Union and in major capitals worldwide. Particular emphasis is placed on a good mix of property locations and types of property (office, shopping center, hotel, logistics) and a healthy mix of tenants. In addition, the aim is to achieve a high tax-free share of the investment performance.

Medium-term portfolio (dynamic): The

investment objective is an appropriate increase in value within the investment. The selected investment instruments invest worldwide in stocks, money market instruments, certificates (e.g. on indices, stocks, bonds, currencies, commodities, investment funds, Reits, real estate funds, hedge funds) and bonds of all kinds according to the principle of risk diversification.

Long-term portfolio (growth):

The assets are invested in global equity funds and equity-related securities. In doing so, we pursue an investment policy oriented towards the value of the substance (value approach). Within the strategy we focus, for example, on undervalued companies that have a high market capitalization and good fundamentals or that pursue very good dividend policies. In the investment process, we concentrate on a precise analysis of the portfolio data and also offer active currency management through special funds in order to generate additional income.

Long-term portfolio (future):

Our investment management invests mainly in funds from smaller continental European companies with above-average growth prospects, partly weighted with emerging markets in selected countries and in future markets such as investments in industry funds or themed funds (healthcare, technology, raw materials).

Asset management GmbH

With the establishment of a GmbH, you as a GmbH shareholder have the opportunity to apply tax benefits to your private assets by transferring them in whole or in part to an asset-managing GmbH. This tax structure is often referred to as “Spardosen-GmbH”.

In practice, an asset management GmbH has three characteristics:

1. The ” Spardosen-GmbH ” for larger investment portfolios

2. The real estate GmbH

3. The Beteiligungs-GmbH for larger company holdings

If a private person has invested a large amount of assets in stocks, funds or ETFs, the vermögensverwaltende GmbH is recommended for investment custody accounts . It is true that in this construct you are not exempt from tax liability for ongoing dividend payments. However, price gains from trading the securities are tax-free even with a lower participation quota, with only 5% non-deductible operating expenses being taxable. Shareholders with investment custody accounts in the six-digit range, which are often reallocated, can benefit enormously from this type of company and do not have to pay any withholding tax.

The reasons for the establishment of a real estate GmbH are primarily to take advantage of the extended trade tax reduction, so that only taxes for corporation tax (15%) and solidarity surcharge are due on the profits of this GmbH form. GmbH shareholders who have a high tax rate in the private sector can thus decouple the property return from their personal tax rate and save up to 20%.

An investment company or holding GmbH that is invested in company holdings of more than 10% (for corporation tax purposes) or 15% (for trade tax) benefits from the so-called box privilege (Section 8b (4) KStG in conjunction with Section 8b (1) KStG). The regulation states that dividends and profit distributions from investments in these companies are tax-free. Only 5% of non-deductible business expenses have to be taxed, which corresponds to a tax burden of less than 2% on the remuneration.

For whom is the vermögensverwaltende GmbH worthwhile?

Basically, this has to be checked individually from person to person. However, it can roughly be said that with assets of at least € 200,000.00 invested in stocks, funds or ETFs and current income of at least € 60,000 per year, the vermögensverwaltende GmbH could be an opportunity to save taxes in the long term and to build up assets . The particular advantage is the permanent retention of the investment income. This means that the profits generated by the company are not distributed, but retained as retained earnings. These in turn are used to finance the company.

Bringing private assets into an asset-managing GmbH also makes sense in connection with the planning of long-term asset transfers. This type of asset transfer is easier than a successive transfer of real estate, stocks or other securities.

The advantages of the vermögensverwaltenden GmbH:

The reasons for the establishment of the GmbH for asset management are complex. Some use this form as a family GmbH in order to later involve their children in the GmbH. This type of transfer is easier than transferring individual properties and stocks in pieces.

Taxpayers with a high tax rate and private assets at least in the six-digit range can benefit from the vermögensverwaltenden GmbH from a tax point of view if they contribute their private assets or parts of them to the company.

The reasons for liability also sometimes play a role. In this case, the really private assets or the standard of living should be protected. For example, your own villa. The income-generating assets and risk participations are then bundled in the GmbH. This is to prevent something from going wrong, including your own house, your old-age provision and maybe your boat or car is gone.

But of course the tax aspects also play an important role. Depending on the design, types of tax can be avoided and tax payments reduced. As a result, assets can grow faster if used correctly.

The disadvantages of the vermögensverwaltenden GmbH:

A major disadvantage are the administrative costs of such a construct. In addition, there are basic costs such as annual financial statements, tax advice or start-up costs for the GmbH. In addition, there are contributions to the Chamber of Commerce and Industry (IHK) and it can also happen that some offers that were still possible as a private person can no longer be realized as a company (e.g. free depots).

It is also important to understand that from a legal point of view, the invested capital no longer belongs to the actual private person, but becomes business assets. It must therefore behave towards the GmbH like an uninvolved person, otherwise the suspicion of hidden profit distributions or deposits could arise. Most shareholders have problems with this point in particular. With a “withdrawal” capital gains tax is due. However, you can pay yourself a salary that reduces the tax burden of the GmbH, but employment as a mini jobber is not possible.

In addition, there is always the risk that there is a long period of time between the conclusion of the notary contract and the entry in the commercial register, during which the GmbH is regarded as the so-called pre-company. Should the GmbH carry out asset management activities during this time that go beyond the preparatory activities, the GmbH is obliged to pay the trade tax.

You should also be informed that publication in the Federal Gazette is also mandatory. This means that your assets can be viewed in the Federal Gazette, which friends or neighbors can also access.

In summary, it can be said that the Spardosen-GmbH offers a good opportunity to optimize your own old-age provision or family security, for example, through continuous asset accumulation, if you can live with the framework conditions.

We would be happy to advise you on the topic individually and independently. Please do not hesitate to contact us.

As a precaution, we would like to point out that the information published on our site has been written and checked by our experts with the greatest care. However, we cannot guarantee the correctness in the long term, as laws and regulations are subject to constant change. We do not accept any liability for damage caused by errors in the texts or false statements.

We would also like to point out that we are not tax advisors and are not allowed to act as tax advisors. However, we work closely with a number of law firms in this field and jointly design concepts for asset management corporations.

Capital-forming benefits (VL)

Asset-forming performance (VL) are payments that the employer (AG) creates for the employee (AN). Whether and to what extent the employee receives capital-forming benefits from his employer is determined by the respective collective bargaining agreement or employment contract. Many companies also pay the capital formation benefits voluntarily, regardless of the collective agreement. The amount of the payment can be up to 40 € per month.

If the employer does not pay any capital-forming benefits for his employee, the employee can ask the employer (in writing) to transfer part of his salary to a VL contract. Payments are only considered VL if the employer transfers them. Furthermore, the employee can also top up his capital-forming benefits.

Capital-forming benefits can be paid into various forms of investment (investment funds, building society contracts, bank savings plans or company pension schemes). The focus of our investment concept is on investing the asset-generating benefits in global or European equity funds.

You can find the legal basis for entitlement in the Fifth Act on the Promotion of Capital Accumulation for Employees.

Additional sources:

http://www.gesetze-im-internet.de/vermbg_2/

Social Trading

The willingness of investors to try out alternative forms of investing is growing. Mainly for this reason, social trading has developed as a new form of financial investment, away from traditional banks, especially in recent years.

Social trading is a form of unregulated investment and asset management for private investors. Professional traders publish their assessments of securities or offer their entire portfolio on social networks so that other investors can view them or replicate them with their own money. Investors can therefore follow the entire trading strategy of the expert and his recommendations live and participate in the success of the investment strategy.

In the meantime, the various social trading portals are no longer startups and have numerous additional functions that make trading generally safer. For more information, visit our Social Trading page .

If you want to start immediately, please use the following link and copy our investment strategy. Our trading name is “dbossenz”.

Here you can directly login .

Important:

Please use the link above and receive an exclusive deposit bonus of $ 200 and a free sky meeting with me.

Insurance for expats in Germany

Expats living and working in Germany as foreigners need to know a few things about the health system in the country. In the following, you will get a brief overview on what to take into account. There can be major differences for EU-, Non-EU and US-Expats. For the latter, please visit the extra info section on our website.

Health insurance for expats in Germany

Germany has a statutory health insurance (Gesetzliche Krankenversicherung – GKV). If you are working in the country and your annual salary is less than 64.350 Euro, you are automatically paying into the system and get an insurance card. It covers a wide range of health needs from visits to doctors, hospitals and medicine. However, for some services like advanced dental care or for some prescriptions additional contributions are required. If you want more services covered, there are additional, voluntary insurances.

For EU citizens coming to Germany temporarily, there is no obligation to take out an insurance. The European Health Insurance Card (EHIC) is valid in this case, unless you register in the country.

Non-EU citizens need to provide a valid German health insurance upon arrival. Otherwise a residence permit will not be granted. Only for international students there are some exceptions, which depend on the country of origin.

One advantage of the statutory health insurance in Germany is, that it covers nursing care insurance, sick leave, child sickness and maternity benefits. Still, you should be careful as these services can have gaps or only come with very basic benefits. It can be useful to take out additional insurances for daily sickness allowance or incapacity.

Employers need to pay half of the costs (excluding additional fees), the employer takes the other half. The maximum individual contribution per month is 323,03 Euro for health care and 56,42 Euro for the nursing care.

The biggest statutory health insurances in Germany are:

- AOK (Allgemeine Ortskrankenkasse – 27 million policyholders)

- TK (Techniker Krankenkasse – 10 million)

- Barmer (9 million)

- DAK Gesundheit (Deutsche Angestellten-Krankenkasse – 5.6 million)

Private health insurances in Germany

For employees with higher incomes and self-employed workers such as entrepreneurs or freelancers there are private health insurances (Private Krankenversicherung – PKV) as an alternative to the statutory ones. Depending on the contract, more advanced and alternative treatments are included. In governmental hospitals this can include head doctor treatment or single-bed rooms. Additionally, there are private hospitals, which do not treat policy holders of statutory health insurances.

One big difference is, that the fee for the statutory health insurance is based on the salary, while privade health insurances calculate their tariffs and services independetly. That is, why they can be cheaper but have the risk of rising rates.

For artists, there are some special regulations with the artists’ social fund (Künstlersozialkasse).

Once in a private health insurance, a return to the statutory health insurance is only possible after significant changes of personal circumstances. It can be very costly.

Work-related insurances in Germany

Like with the statutory health insurance, there are mandatory insurances for employees, which are split half-half with the employer. This includes:

- Unemployment insurance in case the employee loses the job (it is linked to certain conditions)

- Pension insurance for the time after retirement

The accident insurance is completely covered by the employer and pays for medical treatment after work-related casualties.

Other insurances for Expats in Germany

While the health insurance is the only mandatory insurance for living in Germany, it is recommended to take out some more insurances and reduce financial risks.

Personal liability insurance

It is not mandatory, but everyone is recommended to have a personal liability insurance. Self-employed people should consider a business liability insurance, too. It covers damages caused by you (or family members) to other persons or their property. Only damages done by car are not covered.

Car liability insurance

As soon as you want to drive a car, this kind of liability is mandatory. It will cover damages caused by you while using or driving your car. Other than the personal liability insurance, it is not connected to an individual but the car itself. This means: If someone else drives your car, it is still your car liability insurance paying for damages. The car insurance can be extended by two additional services:

- The partial coverage refunds damages on your car caused by casualties like storm, fire, falling rocks or theft attempt.

- The comprehensive coverage even pays for damages on your car, if you caused the accident.

Depending on your personal situation, there are numerous insurances for different purposes. In the following you find a selection of some of the most popular ones:

- Occupational disability insurance

- Personal accident insurance

- Legal insurance

- Household contents insurance

- Building insurance

- Life insurance

Bank accounts and stock portfolios for US-expats in Germany

Other than for EU- and Non-EU-expats there are some particularities to consider for US-expats. In this section you will find the most relevant aspects when it comes to insurances and investments.

How US-expats open a stock portfolio

Since the US government passed the Foreign Account Tax Compliance Act (FATCA), investing in Germany became much more difficult for US-expats. It is designed to prevent citizens from reducing their tax paycheck with foreign bank accounts. For this, it includes additional reporting for banks. In the following, many brokers cancelled the accounts of US-citizens to avoid this extended reporting. However, there are still some banks cooperating with authorities in the US and offer to open accounts and stock portfolios. The easiest way is to look for local offices in cities with US-bases.

What FATCA means for US-expats

The reporting obligations for German bank institutes are massives and include all kinds of bank accounts and stock portfolions. They need to provide the authorities in the US with names, adresses, tax IDs as well as account balances, dividends, interests, gains. The Act applies to all US-citizens, even if they have a second citizenship, and foreigners living in the US with a Green Card.

FATCA was implemented through bilateral agreements. The taxes paid in the country of residence can be cleared with the arising tax payment in the US. This means, that US-expats living in Germany need to submit a tax declaration in the US, even if they do not expect any tax payment there.

Does this mean, FATCA prevents US-expats from opening bank and stock accounts?

No. Although many banks and broker refuse to have US-expats as customers, they are allowed to. They just do not want to have the mentioned extended reporting obligations under FATCA.

Investment for US expats

In recent years, an increasing number of US expatriates have chosen Germany as their new home for work or retirement. However, when it comes to investing in Germany, these expats often encounter unique challenges that can make navigating the financial landscape a complex undertaking.

One prominent hurdle for US expats is the language barrier. While many Germans possess a good command of English, investment-related documentation, contracts, and discussions predominantly occur in German. This barrier can lead to communication issues and misunderstandings.

A professional assistance for US expats from bilingual experts or financial advisors helps to ensure they fully comprehend investment terms and requirements. We are here for you to explain you all the details and investment options.

Investment practices and risk tolerance can vary across cultures, potentially causing US expats to adopt unfamiliar strategies when investing in Germany. Germany’s conservative investment culture, fueled by preferences for stability and low-risk investments, may contrast with the more aggressive and diverse investment styles often seen in the US. US expats may find it essential to align their investment goals with the local investment landscape, requiring adequate research and familiarization with German investment practices and financial products.

As a German agency we are experts for the domestic markets, its peculiarities and opportunities. Together we evaluate the best way for US expats to find their wanted investment strategy considering the situation at the German markets.

Taxation regulations in Germany can be notoriously intricate, presenting another roadblock for US expats. Investors often find themselves grappling with dual taxation issues, as both Germany and the United States require compliance with tax rules. This double taxation can result in additional paperwork, potential penalties, and higher tax liabilities if not carefully managed.

Seeking guidance from tax professionals who specialize in international tax matters is crucial to navigate these complexities. We explain you what to consider and which requirements you need to comply to.

US expats may encounter limitations on certain investment options in Germany due to their US citizenship. Some financial institutions are wary of accepting US clients due to the stringent compliance requirements imposed by the US Internal Revenue Service (IRS). US regulations, such as the Foreign Account Tax Compliance Act (FATCA), can also create compliance burdens for foreign institutions seeking to accommodate American clients. Consequently, US expats might have restricted access to certain investment vehicles, necessitating careful research or engaging specialized financial advisors.

One solution can be a precious metal depot for US expats. Thanks to our professional and reliable network we can open a depot for you, which meets all legal requirements for German and US law.

As you can see, Germany offers a host of opportunities and a stable economic environment for US expats. However, investing in the country can be connected to challenges. We are specialized in assisting US expats navigate the German investment landscape with professional guidance. By doing so, US expats can make informed decisions and overcome the hurdles, allowing them to secure their financial future in their new German home.

No subscription fee. Only 0.5% service fee.

In addition to the performance of the respective investment strategy, low fees are the decisive criterion for the overall success of your investment. Here, too, we are setting new standards as an independent asset manager: there is no front – end load that is customary in the industry when buying fund units with us . You save – depending on the product – up to 5 percent and more of the investment amount, benefit from a higher return, a stronger compound interest effect and greater flexibility.

In addition, as our customer, you can look forward to an extremely low annual service fee of only 0.5 percent of the current depot value (plus VAT). We take this fee for our asset management from your custody account on a quarterly basis. Compare for yourself how attractive our prices are compared to traditional asset managers.

Our sample portfolios

The financial markets are constantly developing and changing. In addition, the volatility of the financial markets has generally increased in recent years. The management of your own assets has become much more complex and makes it impossible for borrowers to manage their finances professionally.

We therefore stand by your side as an independent partner and find the right solutions for your wealth accumulation. Together with you, we create an individual investment strategy based on your investment profile and then select the right investment portfolio for you.

We know the circumstances of our customers and know that the flexibility of an investment is a high priority for most people. We have therefore designed our portfolios with a balanced ratio of flexibility, security and returns. Below are some of our sample portfolios.

Short term portfolio (security)

Our short-term portfolio is particularly suitable for short-term investments with secure income and almost no risk due to price fluctuations.

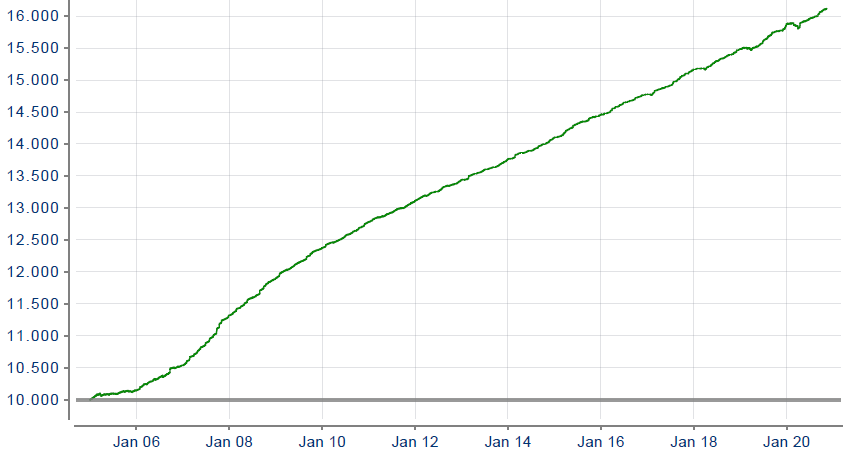

Average performance (since 2006): 2.94% per year

Average volatility: 0.81%

Recommended minimum investment horizon: 2-3 years

Medium-term portfolio (conservative)

This portfolio ensures stable returns with low risk due to low price fluctuations.

Average performance (since 2005): 4.49% per year

Average volatility: 2.64%

Recommended minimum investment horizon: 3-5 years

Long-term portfolio (growth)

This deposit focuses on achieving above-average returns and tries to limit losses despite the higher risk. This approach is particularly suitable for long-term oriented investors with higher return expectations.

Average performance (since 2005): 7.89% per year

Average volatility: 6.32%

Recommended minimum investment horizon: 5-7 years

Retirement provision portfolio (dynamic)

Our old-age provision custody accounts are profit-oriented and dynamic with a long investment horizon. Our goal is that our customers are financially independent in retirement.

Average performance (since 2005): 11.33% per year

Average volatility: 9.34%

Recommended minimum investment horizon: 7-9 years

Future Portfolio (future markets)

This compilation of deposits is only for the experienced and / or people with patience. The high-yield investments in future markets are also associated with an increased risk. Time is our most loyal ally here. The future portfolio can also be integrated as part of an investment strategy.

Average performance (since 2005): 15.32% per year

Average volatility: 14.22%

Recommended minimum investment horizon: 10-15 years

Incorrect saving behavior

According to many studies, a large part of the German population saves incorrectly and misses out on billions in returns every year. The most popular forms of savings are the savings book or call money accounts, although these hardly promise any interest. It is frightening that most Germans receive less return on their savings than the level of inflation. We therefore show our customers alternatives to the classic forms of investment and answer all questions about the topics of asset accumulation, shares, investments, funds and certificates.

Our independence is your freedom.

Our mission is to enable everyone to have professional and individual wealth management.

Our services

- Transparent advice

- Professional fund selection

- Continuous optimization

Thanks to our independence, you can enjoy the good feeling of always being given objective advice. As your asset manager, our investment recommendations are based exclusively on the performance of your capital. For example, you have the option of adapting your depot to changing circumstances at any time, at no cost.

We would be happy to show you how you can use intelligent investment management to increase your return while minimizing your risk.

Get advice now